Interview CNRS de Frédérique Marchand-Beaulieu, ingénieure d’études et assistante de prévention au sein d’AOROC.

Édito

Nous saluons la parution de deux ouvrages importants pour notre laboratoire.

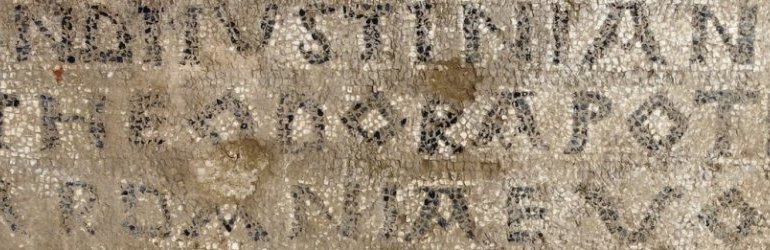

Le premier, Le Catalogue des inscriptions étrusques de la Bibliothèque nationale de France, est le dernier ouvrage de D. Briquel, professeur émérite à Sorbonne Université et ancien directeur d’AOROC, consacré à la très riche collection des inscriptions étrusques de ce que l’on appelait encore il y a peu le Cabinet des médailles de Paris. Comme le rappelle l’auteur, la cabinet, est l’ « héritier de l’ancien Cabinet du roi, enrichi par des saisies révolutionnaires et ayant bénéficié d’une série de dons et legs – plus que d’achats, qui furent relativement rares –, il contient des documents exceptionnels, comme des dés à jouer qui portent, inscrits sur leurs faces, les chiffres étrusques de un à six, que nous ne connaissons que par-là ». Pas plus que la collection du Louvre, dont le catalogue avait été publié en 2016 par D. Briquel, celle du cabinet des Médailles n’avait fait l’objet d’une étude systématique. C’est donc chose faite maintenant, avec cet ouvrage édité par la Bibliothèque Nationale de France, avec le soutien d’AOROC, dont le riche apparat de dessins des inscriptions a été réalisé par notre collègue, C. Bailly (CNRS/AOROC).

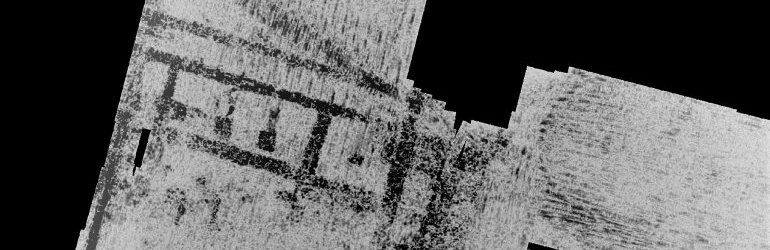

Le second, La prospection archéo-géophysique. Détection et cartographie non destructives du patrimoine enfoui est la monographie que M. Dabas, directeur de recherche au CNRS et ancien directeur adjoint d’AOROC, a consacré à l’archéo-géophysique, à son histoire, à ses méthodes, comme à l’évaluation de ses objectifs. Comme l’explique M. Dabas, « Dans un premier temps la démarche était prédictive et visait à la détection de sites. Puis les questions posées au géophysicien ont évolué vers une démarche cartographique : délimitation fine de sites, détails sur leur structuration interne. L’évolution de l’instrumentation géophysique a permis de cartographier des zones de plus en plus importantes alors même que les méthodes actuelles de fouille autorisent seulement l’étude de surfaces limitées. Si l’on a pu opposer l’approche extensive de la géophysique à l’approche intensive des fouilles, cette opposition n’est qu’apparente : outil d’anticipation et de planification, la carte géophysique, si elle est croisée avec des sondages, est un formidable outil non destructif mis à la disposition de l’aménagement du territoire et de la préservation du patrimoine enfoui. ». Ce livre est au cœur de la révolution des travaux de terrain en archéologie, dont AOROC reste l’un des principaux acteurs en Europe,en grande partie grâce au travail de M. Dabas.

On ne peut que féliciter ces deux membres de notre laboratoire qui offrent à notre communauté scientifique et universitaire deux ouvrages fondamentaux qui font honneur à AOROC.

Christophe J. Goddard

Directeur d’AOROC

Brèves

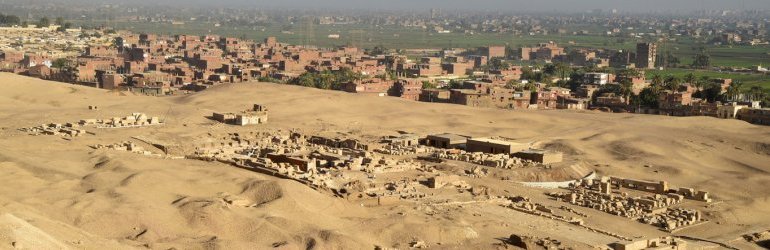

Dans le cadre du programme de recherche NAHAN (North African Heritage Archives Network), le laboratoire AOROC propose un stage de 3 mois avec pour missions la numérisation, la description et la diffusion de fonds d’archives portant sur l’archéologie et le patrimoine nord-africains.

Actualités

L'actualité des humanités numériques d'AOROC est aussi disponible dans la newsletter du pôle HN.

Mercredi 6 mars 2024, 9 à 13h, Salle de paléographie

Mercredi 17 avril 2024, 9 à 13h, Salle IHMC

Mercredi 5 juin, 9 à 13h, Archéo-Chapelle

Les mercredis 13 et 20 mars de 10h30 à 12h30 en salle de séminaire.

Les vendredis 22 et 29 mars de 14h à 16h en salle de conférence (46 rue d’Ulm).

Format hybride

Séance à l’Université de Lausanne, le mardi 26 mars, 9h-16h45 (salle Amphimax 414).

Journée d’étude dans le cadre du séminaire Histoire de la construction

Paris, June, 3-9, 2024

CIACParis2024@gmail.com